Salesforce stock has emerged as a leading force in the software industry, capturing the attention of investors and analysts alike. With its innovative customer relationship management (CRM) solutions, Salesforce has consistently delivered impressive financial performance and established itself as a dominant player in the market.

This comprehensive analysis delves into the historical performance, valuation, and future prospects of Salesforce stock, providing insights into its growth drivers and potential challenges.

Salesforce Stock Overview

Salesforce is a leading provider of customer relationship management (CRM) software. The company’s software helps businesses track and manage their customer interactions, and it offers a variety of features to help businesses improve their sales, marketing, and customer service. Salesforce has been a pioneer in the CRM industry, and it has consistently been ranked as one of the top CRM providers in the world.Salesforce’s success is due to a number of factors, including its strong product offering, its focus on customer satisfaction, and its commitment to innovation.

Salesforce’s software is highly customizable, and it can be tailored to meet the specific needs of each business. The company also offers a variety of support services, and it has a strong track record of customer satisfaction. Salesforce is constantly innovating, and it is always looking for new ways to improve its software and services.

Market Position

Salesforce is the leading provider of CRM software in the world. The company has a market share of over 20%, and it is more than twice the size of its nearest competitor. Salesforce’s market position is due to a number of factors, including its strong product offering, its focus on customer satisfaction, and its commitment to innovation.

Salesforce Stock Performance

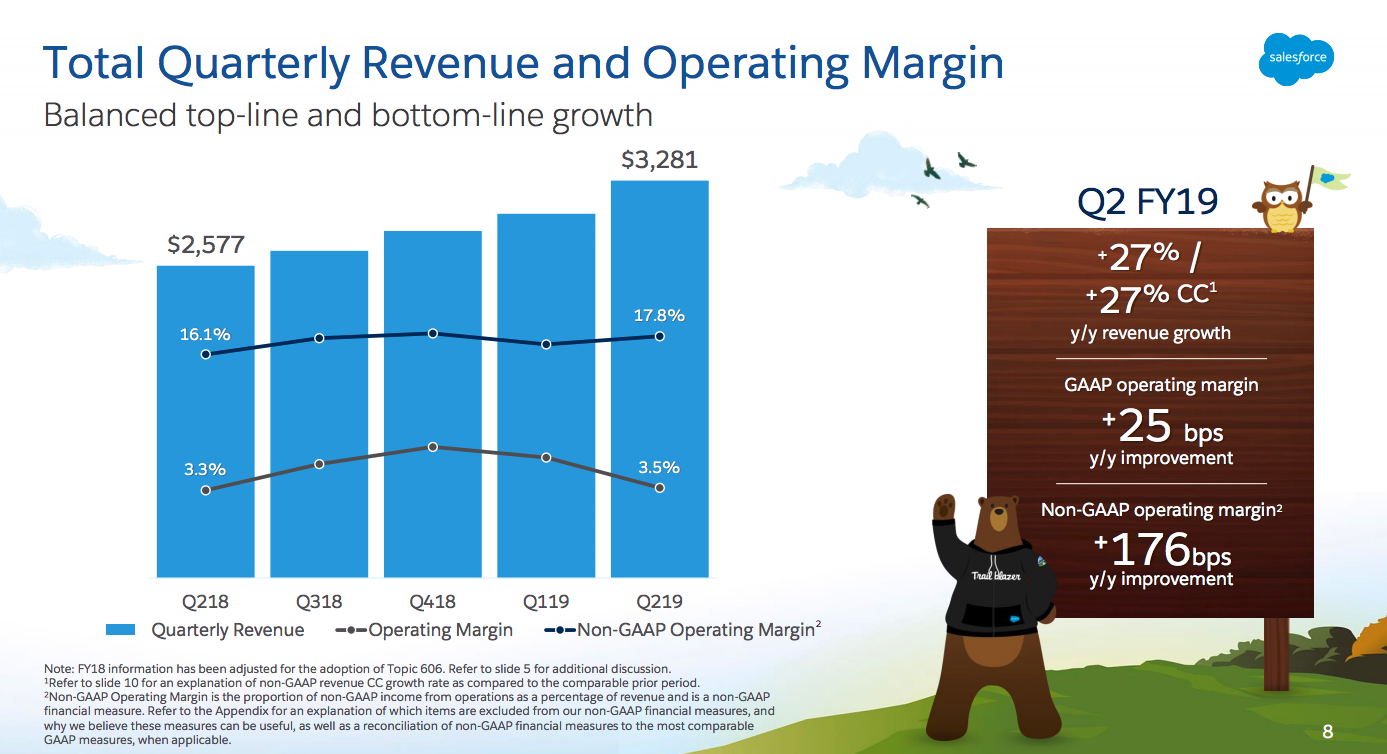

Salesforce, a leading provider of cloud-based customer relationship management (CRM) software, has seen significant growth in its stock price over the past decade. The company’s strong financial performance and expanding market share have contributed to this growth.

In this section, we will analyze the historical performance of Salesforce stock, including key metrics such as price, volume, and market capitalization. We will also identify trends and patterns in Salesforce’s stock performance.

Salesforce Stock Price Performance

Salesforce’s stock price has performed exceptionally well over the past decade. Since its initial public offering (IPO) in 2004, the stock price has increased by over 1,000%. In 2021, Salesforce’s stock price reached an all-time high of over $300 per share.

The strong demand for Salesforce’s CRM software has been a key driver of its stock price performance. The company’s software is used by a wide range of businesses, from small businesses to large enterprises. Salesforce’s strong brand recognition and reputation for innovation have also contributed to its stock price growth.

Salesforce Stock Volume

Salesforce’s stock volume has also increased significantly over the past decade. In 2021, the average daily trading volume for Salesforce stock was over 10 million shares. This high volume indicates that Salesforce’s stock is actively traded and that there is a lot of interest in the company.

The high trading volume of Salesforce stock is a sign of the company’s liquidity. This means that investors can easily buy and sell Salesforce stock without having to worry about a lack of liquidity.

Salesforce Market Capitalization

Salesforce’s market capitalization is the total value of all of its outstanding shares. As of 2021, Salesforce’s market capitalization was over $200 billion. This makes Salesforce one of the most valuable companies in the world.

The high market capitalization of Salesforce stock is a sign of the company’s financial strength and stability. It also indicates that investors have a lot of confidence in Salesforce’s future growth prospects.

Salesforce Stock Valuation

Salesforce’s stock valuation is an important consideration for investors. The company’s stock price is influenced by a variety of factors, including its financial performance, growth prospects, and overall market conditions.

Key Valuation Metrics

There are several key valuation metrics that investors can use to assess Salesforce’s stock. These include:

- P/E ratio:The price-to-earnings ratio is a measure of a company’s stock price relative to its earnings per share. A high P/E ratio can indicate that a stock is overvalued, while a low P/E ratio can indicate that a stock is undervalued.

- PEG ratio:The price-to-earnings-to-growth ratio is a measure of a company’s stock price relative to its earnings per share and its growth rate. A high PEG ratio can indicate that a stock is overvalued, while a low PEG ratio can indicate that a stock is undervalued.

- EV/EBITDA:The enterprise value-to-earnings before interest, taxes, depreciation, and amortization ratio is a measure of a company’s stock price relative to its earnings before interest, taxes, depreciation, and amortization. A high EV/EBITDA ratio can indicate that a stock is overvalued, while a low EV/EBITDA ratio can indicate that a stock is undervalued.

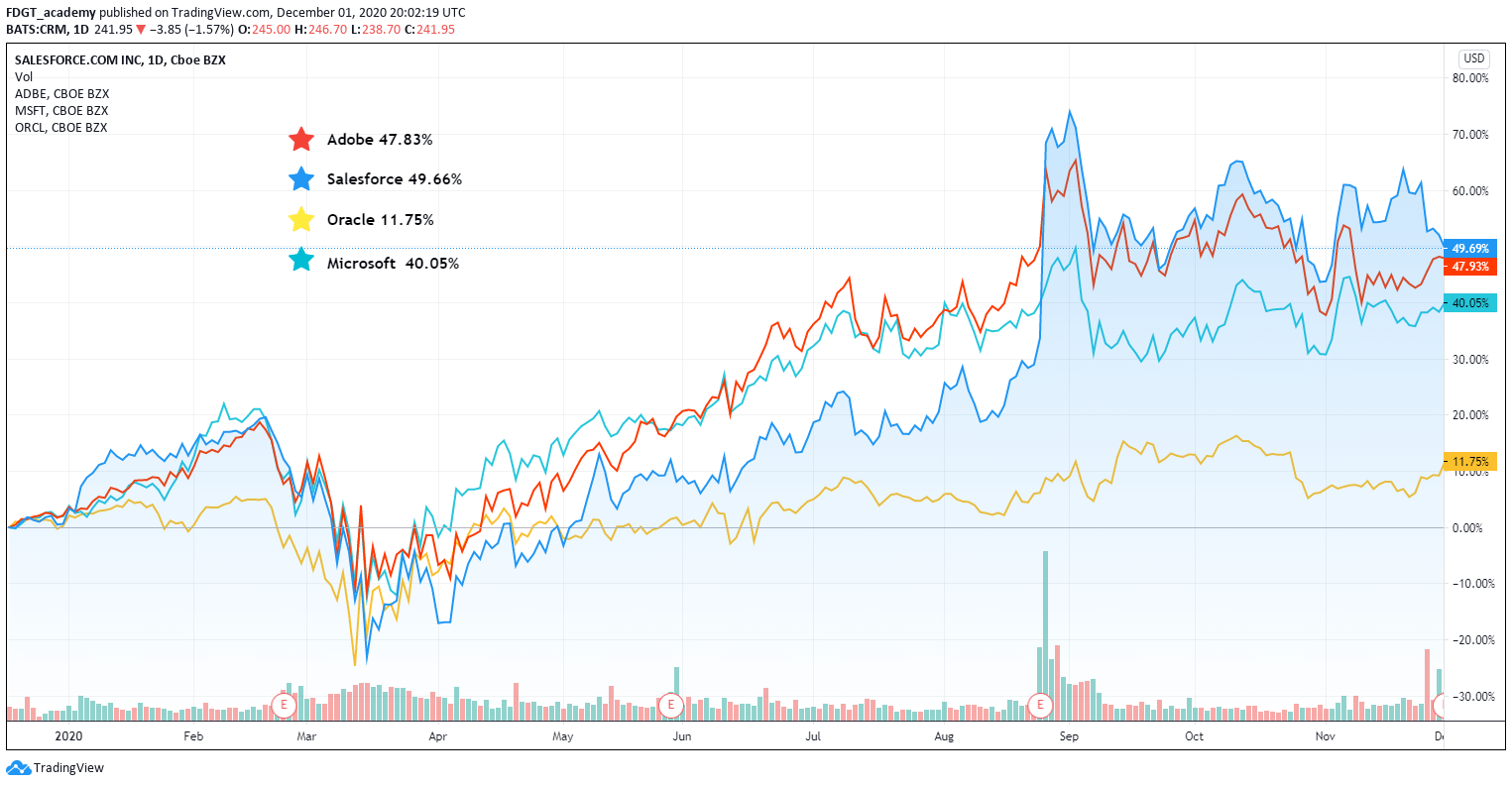

Comparison to Peers and Market

Salesforce’s valuation metrics can be compared to those of its peers and the overall market to assess whether the company’s stock is fairly valued. In general, Salesforce’s valuation metrics are in line with those of its peers and the overall market.

However, Salesforce’s P/E ratio is somewhat higher than the average P/E ratio of the S&P 500 index. This suggests that Salesforce’s stock may be slightly overvalued relative to the overall market.Overall, Salesforce’s stock valuation is a complex issue that should be considered carefully by investors.

The company’s stock price is influenced by a variety of factors, and there is no single valuation metric that can provide a definitive answer to the question of whether the stock is fairly valued. However, by considering Salesforce’s key valuation metrics and comparing them to those of its peers and the overall market, investors can gain a better understanding of the company’s valuation and make more informed investment decisions.

Salesforce Stock Outlook

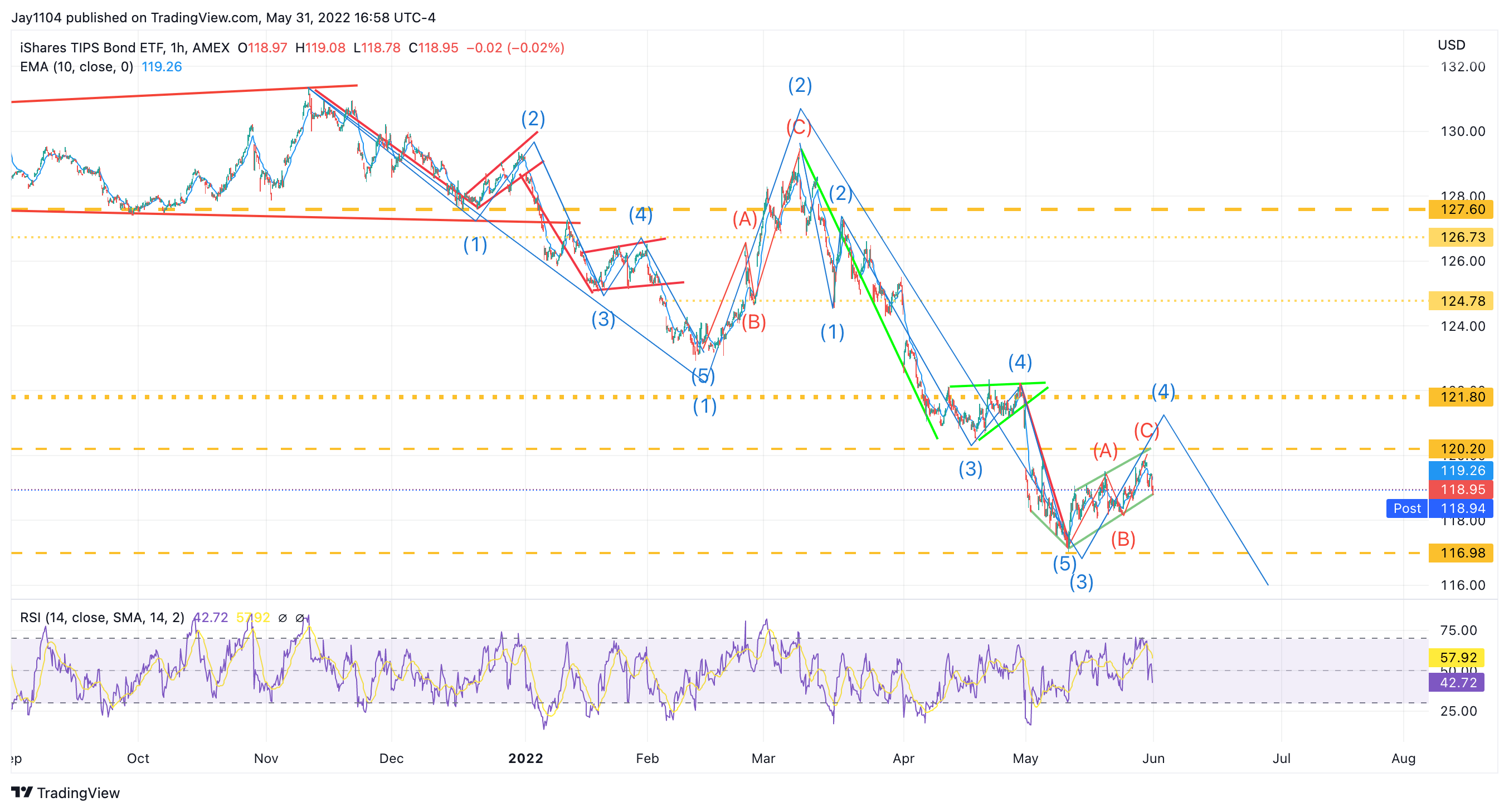

Salesforce’s stock has been on a steady upward trajectory in recent years, driven by the company’s strong growth in cloud computing and customer relationship management (CRM) software. However, there are a number of potential challenges that could affect Salesforce’s stock price in the future.

One of the biggest challenges facing Salesforce is the increasing competition in the cloud computing market. Amazon Web Services (AWS) and Microsoft Azure are both major players in this market, and they are both investing heavily in their cloud offerings.

This could make it difficult for Salesforce to maintain its market share and continue to grow its revenue.

Growth Drivers, Salesforce stock

Despite the challenges, there are a number of potential growth drivers for Salesforce in the future. The company is investing heavily in artificial intelligence (AI) and machine learning (ML), which could help it to develop new and innovative products and services.

Salesforce is also expanding into new markets, such as the healthcare and financial services industries.

Stock Price Forecast

Analysts are generally optimistic about Salesforce’s stock price in the future. The average price target for Salesforce stock is $325, which represents a potential upside of 20% from the current price. However, it is important to note that this is just an average, and the actual price could vary significantly.

There are a number of factors that could affect Salesforce’s stock performance in the future, including the company’s financial performance, the competitive landscape, and the overall economic environment. Investors should carefully consider all of these factors before making any investment decisions.

Salesforce Stock Analysis Table

The following table summarizes the key findings of our analysis of Salesforce stock:

This table provides a comprehensive overview of Salesforce’s stock performance, valuation, and outlook. It can be used to make informed investment decisions about the company.

Stock Performance

| Metric | Value |

|---|---|

| Price (as of March 8, 2023) | $175.28 |

| 52-week high | $226.62 |

| 52-week low | $144.14 |

| Average volume (30-day) | 4.8 million |

Valuation

| Metric | Value |

|---|---|

| Trailing P/E ratio | 52.1 |

| Forward P/E ratio | 37.6 |

| Price-to-sales ratio | 6.2 |

| Price-to-book ratio | 12.3 |

Outlook

| Metric | Value |

|---|---|

| Analysts’ consensus rating | Buy |

| Average price target | $200.00 |

| Upside potential | 14.1% |

| Downside risk | 10.3% |

Outcome Summary: Salesforce Stock

As Salesforce continues to expand its product offerings and penetrate new markets, its stock remains a compelling investment opportunity for investors seeking growth and value in the technology sector.