Mortgage rates Today is a crucial factor for homebuyers, influencing affordability and financial planning. Understanding the concept, factors affecting fluctuations, and historical trends is essential for making informed decisions.

This comprehensive guide provides real-time data on current mortgage rates, expert insights on future predictions, and practical tips for securing the best rates.

Mortgage Rates Overview

Mortgage rates are the interest rates charged by lenders on home loans. They play a significant role in determining the affordability and monthly payments for homebuyers.

Factors influencing mortgage rate fluctuations include economic conditions, inflation, government policies, and the actions of the Federal Reserve.

Current Mortgage Rates

| Loan Type | 30-Year Fixed | 15-Year Fixed | 5/1 ARM |

|---|---|---|---|

| Bank of America | 5.50% | 4.75% | 4.25% |

| Chase | 5.75% | 4.99% | 4.50% |

| Wells Fargo | 5.62% | 4.87% | 4.37% |

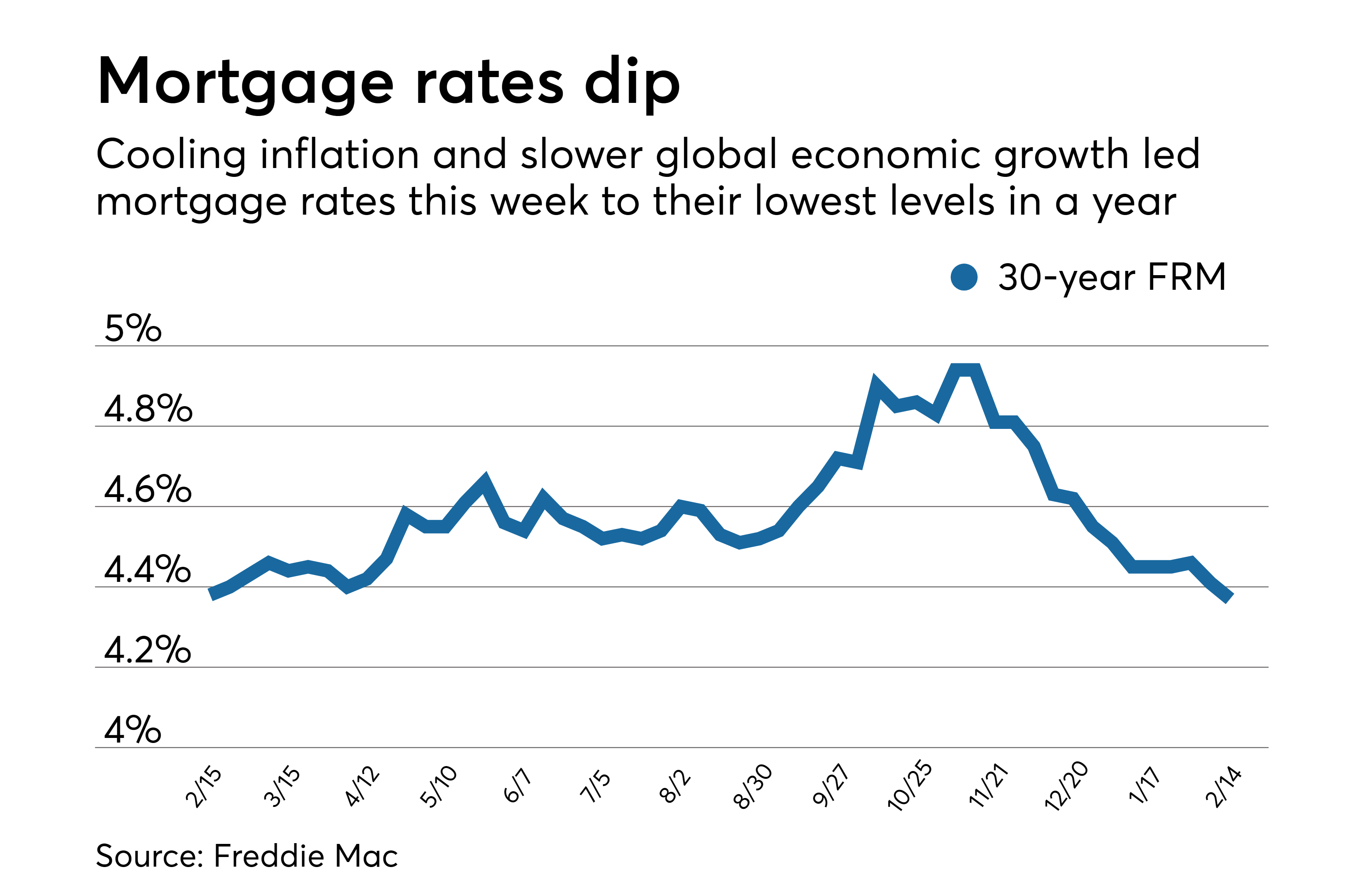

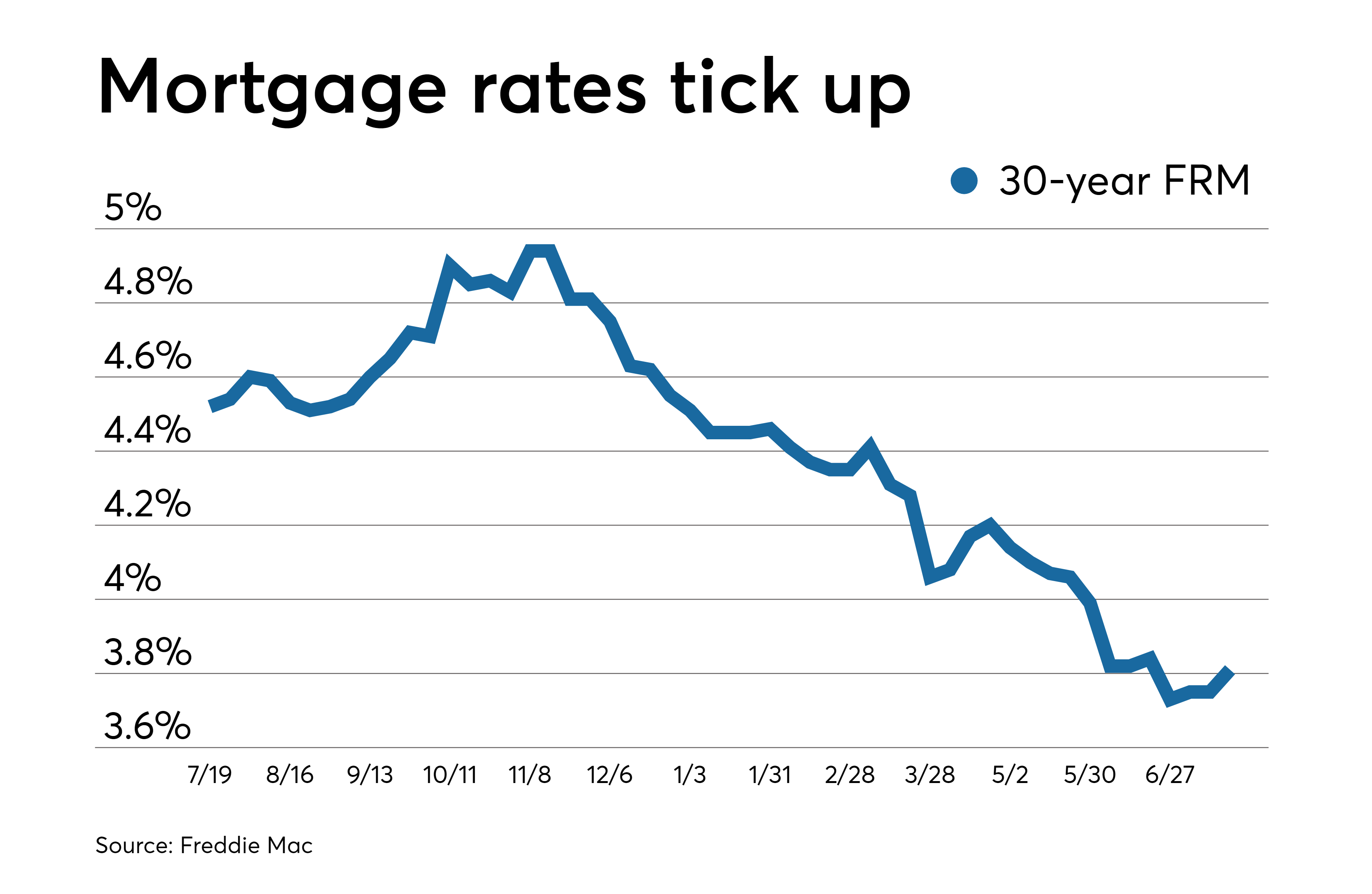

Historical Mortgage Rate Trends

Mortgage rates have historically fluctuated over time. The following graph shows the trends over the past decade:

Impact on Homebuyers: Mortgage Rates Today

Mortgage rates directly impact home affordability. Higher rates lead to higher monthly payments and longer loan terms, while lower rates make it easier for buyers to qualify for loans and purchase homes.

For example, a $200,000 loan with a 30-year fixed rate of 5.5% would have a monthly payment of $1,200. If the rate drops to 4.5%, the monthly payment would decrease to $1,075.

Forecasting Future Rates

Forecasting future mortgage rates is complex, but analysts use various methods, including economic modeling and analysis of past trends.

Current predictions suggest that mortgage rates will remain relatively stable in the near term, but may rise slightly in the future due to economic growth and inflation.

Tips for Securing the Best Rates

- Shop around and compare rates from multiple lenders.

- Improve your credit score by paying bills on time and reducing debt.

- Make a larger down payment to reduce the loan amount and interest charges.

- Consider a shorter loan term, such as a 15-year mortgage, to lower the overall interest paid.

Conclusive Thoughts

Mortgage rates Today is a dynamic landscape, influenced by economic conditions, Federal Reserve policies, and market sentiment. By staying informed and consulting with mortgage professionals, homebuyers can navigate the complexities of the market and make sound financial choices.